15 December, 2011

Costing: Plum report shows negative impact of lower copper prices on next generation access investment and coverage

A Plum report for ETNO published today demonstrates that lowering the price of copper envisaged by the European Commission in its consultation as one of the possible options would have a negative impact on investment by existing network operators and entrants, thereby affecting the Digital Agenda objectives.

Brussels – A Plum report for ETNO published today demonstrates that lowering the price of copper envisaged by the European Commission in its consultation as one of the possible options would have a negative impact on investment by existing network operators and entrants, thereby affecting the Digital Agenda objectives.

“Long-term investments in fibre networks require a stable framework and credible regulatory commitment. Discussions about possible disruptive changes in costing methodology have already undermined investors’ confidence”, comments Brian Williamson, Plum.

For an independent fibre entrant, or for a competing wireless or cable platform, lowering the price of copper would unambiguously harm investment since it would lower retail prices in the market for both current and next generation access and thus reduce demand and/or lower the price for fibre. Lowering copper prices would moreover reduce free cash flow, which is likely to reduce discretionary capital expenditure on infrastructure by the established operators in order to maintain investor returns.

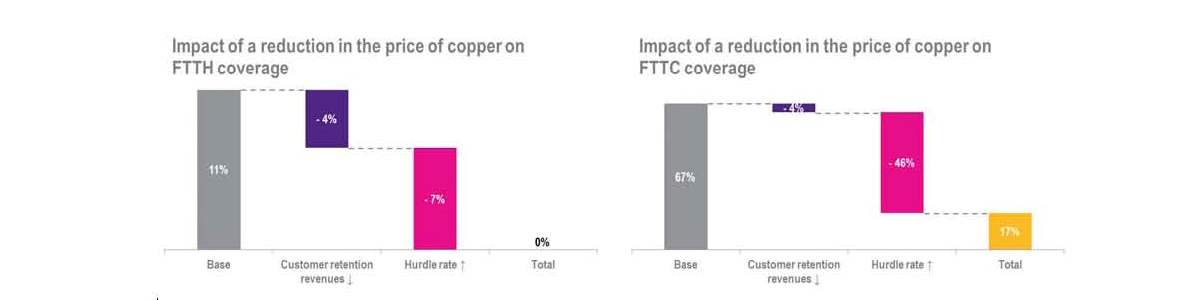

The report also analyses the impact of a change in the copper price on investment in next generation access in quantitative terms. The analysis based on the Plum Access Investment Model (AIM) demonstrates that a reduction in the price of copper by a hypothetical one-third from €9 to €6 per month would reduce FTTH (Fibre to the Home) coverage from 11% by 4 and 7 percentage points respectively to zero.

For FTTC (Fibre to the curb) coverage is reduced from 67% to 17%.

Plum considers that a favourable regulatory mix involving a rising copper price (and the signal of commitment this implies) combined with the pricing freedom to permit service-price differentiation and dynamic evolution of prices, would on the contrary result in an increase of FTTH coverage to 30% whilst FTTC coverage increases to 76%.

The report calls for maintaining a technology neutral approach and maximising the potential of all technology platforms (fibre, copper VDSL through vectoring, cable, next generation mobile networks, …) capable of achieving the Digital Agenda targets.

“The report by Plum underlines that infrastructure competition remains a key driver for innovation, efficient investment and consumer choice, allowing significant economic welfare gains over time.” says Ralf Nigge, Chairman of ETNO’s Competitive Markets Working Group. Regulation during transition to NGA should not harm the development of platform competition.

For more information, please contact: Thierry Dieu, ETNO Acting Director/ Communications Manager Tel: (32-2) 219 32 42 Fax: (32-2) 219 64 12 E-mail: dieu@etno.be

ETNO’s 40 member companies and 10 observers from Europe and beyond represent a significant part of total ICT activity in Europe. They account for an aggregate annual turnover of more than €600 billion and employ over 1.6 million people. ETNO companies are the main drivers of broadband and are committed to its continual growth in Europe.

Download Plum Report